- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

This High-Yield Dividend Stock Doesn’t Look Tasty After Earnings. Should You Ditch Shares Here?

Popular fast-food hamburger chain operator Wendy's (WEN) has guided for a global system-wide sales decline of 3% to 5% this year, higher than its earlier assertions of a flat to 2% decline, as pressure on the consumer's pockets begins to make an impact on the company's operations.

A key indicator of this is the University of Michigan's index for consumer expectations. In April, the index fell by 32% since January, its sharpest decline since the country was rocked by a recession in 1990. Moreover, inflation expectations among consumers surged to 6.5% for the year, the highest reading since 1981. Meanwhile, although inflation remained stable, both the headline inflation at 2.7% and core inflation at 3.1%, remained above the Federal Reserve's 2% target.

Thus, Wendy's guidance cut seems in tune with the muted consumer sentiments. However, investors can consider the WEN stock for a reason that may be just what a portfolio needs in these uncertain times: income certainty.

About Wendy's

Founded in 1969, Wendy's is widely recognized worldwide for its square-shaped burgers made with fresh beef, as well as staples like the Frosty, spicy chicken sandwiches, and the Baconator. Its market cap currently stands at $2 billion.

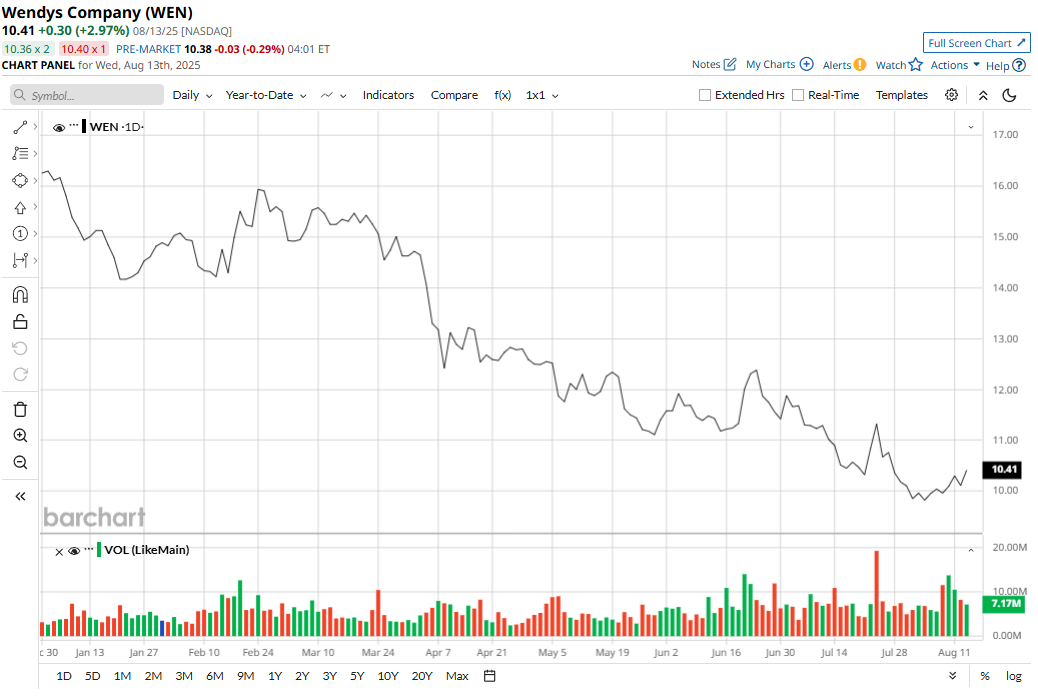

Although the WEN stock is down 35% on a YTD basis, the stock offers a dividend yield of 8.44%, which is much higher than the sector median of 1.056%. However, with a payout ratio of 90%, the scope for further growth remains limited.

So, is it worth taking a bite at Wendy's stock, considering its high dividend yield, which may not have growth sustainability, or does it warrant an investment for other reasons?

Declining Sales, Store Count (But That's Not The Whole Story)

Notwithstanding the fall in Q2 2025 sales, Wendy's reported a beat on both revenue and earnings in the latest quarter. In fact, over the past nine quarters, the company's earnings have only missed expectations on just three occasions.

Q2 2025 saw the company reporting sales of $560.9 million, down 1.72% from the previous year. Earnings, however, increased to $0.29 per share from $0.27 per share in the year-ago period, also coming in higher than the consensus estimate of $0.25 per share.

Same-restaurant sales growth saw a decline of 3.6% in the US, but it saw a rise of 1.8% internationally. Overall, globally, the metric was down 2.9% in Q2 2025. Notably, global restaurant count saw an uptick to 7,334 from 7,261 in the year-ago period. While the count dwindled in the U.S. to 5,967 from 6,013, it rose to 1,367 from 1,248 internationally.

Cash flow from operations for the first six months of 2025 was also higher at $146 million compared to $145.5 million in the prior year. Overall, Wendy's closed the June quarter with a cash balance of $281.2 million, which was higher than its short-term debt levels of $232.5 million.

Moreover, not just dividends, Wendy's rewarded shareholders with share repurchases worth $61.9 million in the quarter, with buybacks worth $8.8 million already done till Aug. 1. The company informed that it has an additional $40.2 million available for its share repurchase program that expires in February 2027.

Visible Efforts For Growth

After establishing a strong foothold in its domestic market of the U.S., Wendy's has plans to grow its international footprint. This is a prudent strategic move on the part of the company amid the aforementioned consumer troubles, while increasing focus towards other high-growth markets.

Over the next three years, the company intends to add 300 domestic outlets alongside 700 new locations abroad. By 2028, management aims to establish 2,000 international restaurants, with an additional 170 outlets planned for Italy through 2035. Furthermore, a franchise agreement has been secured to introduce 20 restaurants in Armenia by the year 2030.

In parallel, Wendy’s has undertaken several efficiency measures designed to enhance both operating margins and cash flow generation. Among these, the rollout of digital menu boards and AI-enabled order-taking across select restaurants has already demonstrated an ability to lower labor costs while boosting average customer spend. The firm anticipates that at least 500 of its locations will incorporate these technologies.

Additionally, the brand also relies heavily on locally sourced inputs across its operations. In the United States, 95% of ingredients are procured domestically, while all beef served in Canadian outlets is sourced from Canadian producers. This procurement strategy reduces exposure to tariffs, thereby protecting margins and cash flow from cost volatility linked to trade policies.

Notably, marketing efforts have included high-visibility promotions such as the “100 Days of Summer” campaign, which featured its Jr. Bacon Cheeseburger for one cent on National Hamburger Day and priced the Dave’s Single at one dollar from June 7 through July 26. In addition, the company has pursued collaborations to diversify menu offerings, partnering with Takis to launch the Takis Fuego Meal on June 20 and introducing the exclusive Lonely Ghost’s Saucy Nuggs, aimed at increasing engagement among younger consumers.

However, risks in the form of a global economic slowdown can render all these strategic initiatives useless and the company may be on a long, painful path of flat or even declining revenues and profitability. Moreover, intense competitive pressure from much larger peers such as Burger King, KFC and McDonald's (MCD), vulnerability to raw material costs rise, and continued heavy investments in technological upgrades remain key challenges that the company must navigate smartly to realize its growth potential.

Analyst Opinion

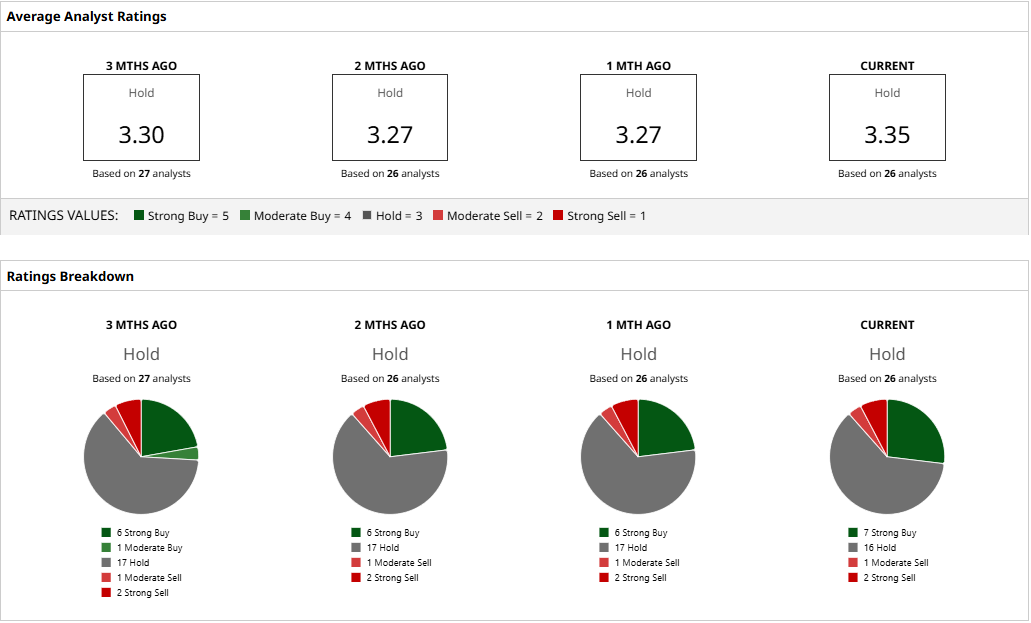

Thus, analysts have deemed the WEN stock a “Hold” with a mean target price of $12.55. This indicates an upside potential of about 22% from current levels. Out of 26 analysts covering the stock, seven have a “Strong Buy” rating, 16 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.