- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Weather & Your Wallet: How a developing La Niña is affecting commodity prices

(ZSX25) (ZWZ25) (ZCZ25) (SOYB) (WEAT) (CORN) (TAGS) (DBA) (KCH26) (CCH26) (SBH26) (CANE)

“Weather & Your Wallet: How a developing La Niña is affecting commodity prices”

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Weekend Report - October 10-13, 2025

This video points out the power of weather on commodity markets. How can you potentially profit using the weather in your investment portfolio?

To start our video > > > PLEASE CLICK HERE

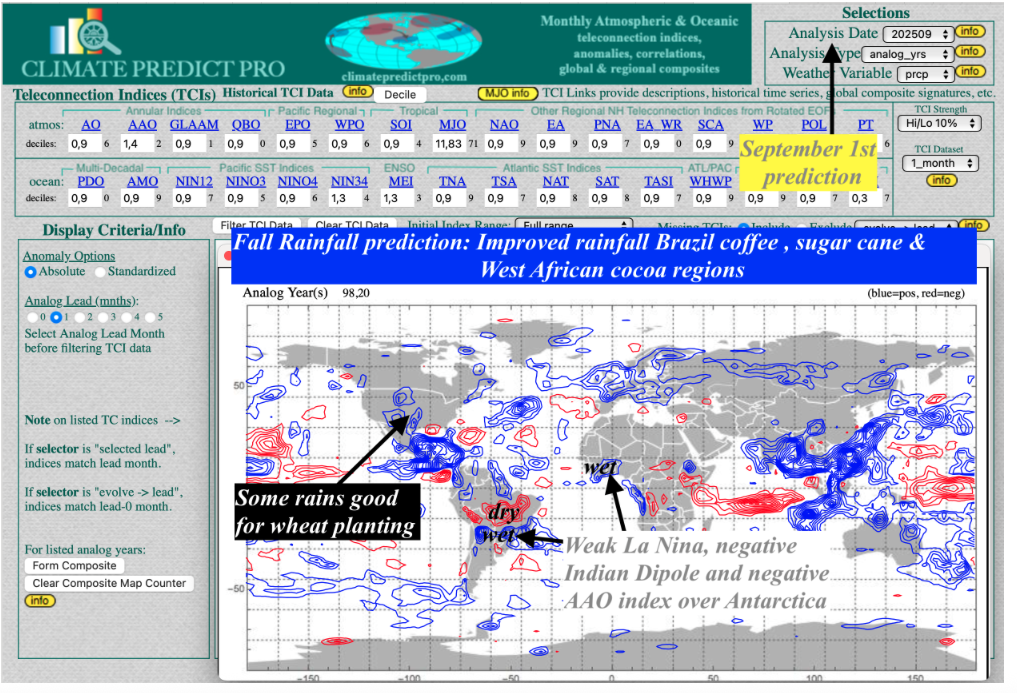

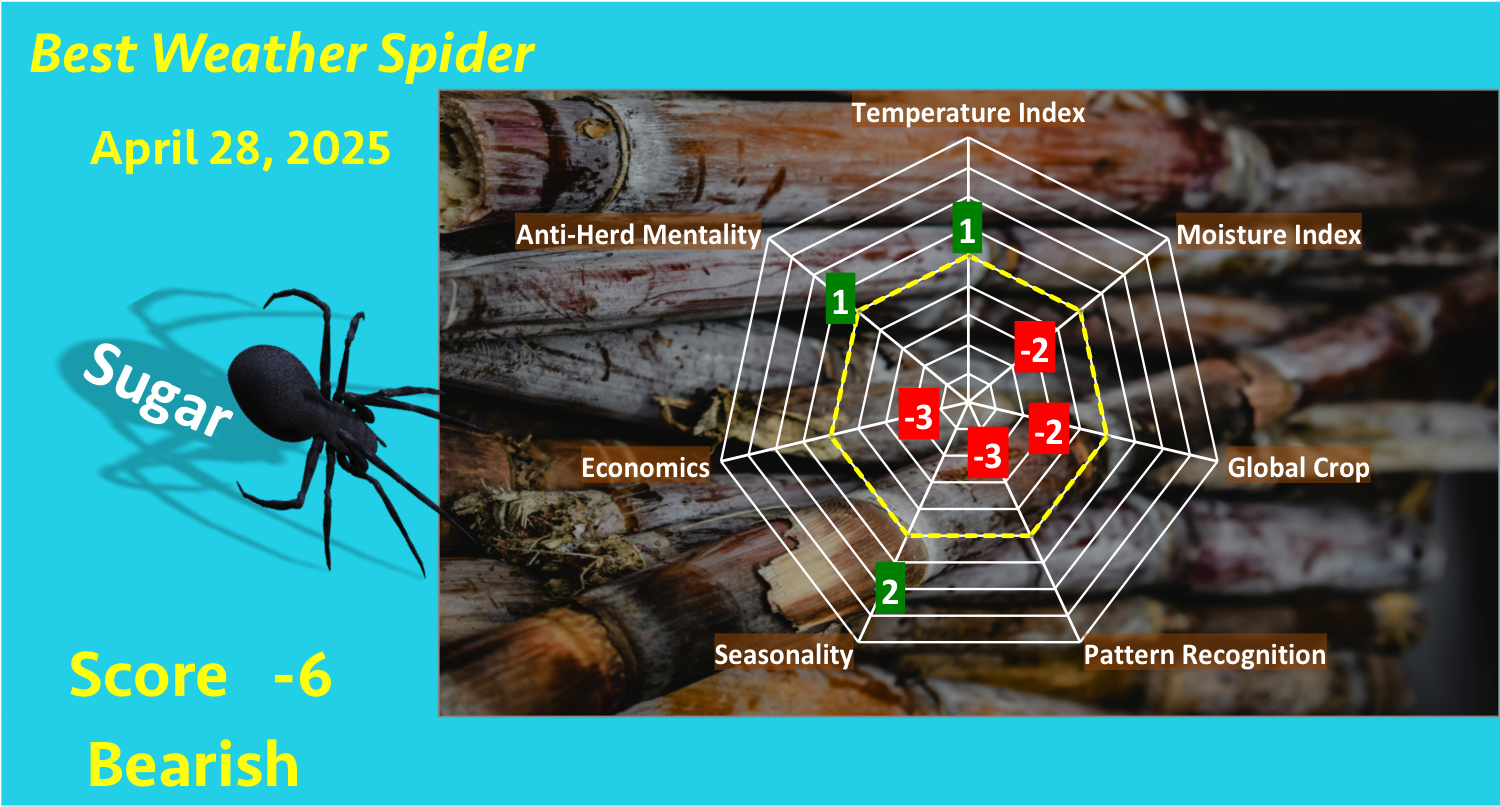

Most recently, a developing La Niña event combined with a negative Indian Ocean Dipole in the Pacific and a weak negative Antarctic Oscillation Index is causing bear markets in cocoa and sugar. Coffee prices may be next (especially if trade tariff tensions ease with Brazil), as we have been predicting the end of Brazil's multi-year drought for two months.

In addition, the rains in Australia and generally good global wheat crops have kept the wheat futures markets in a downtrend. Could that change next year with La Niña?

Image Source: Climate Predict (a BestWeather company)

While the grain market has been hurt by more record global crops, trade tariffs, and poor demand, could La Niña end the bear market by 2026? It is possible.

The US corn crop has come down from a dry late summer and disease issues, and may be the one lone bullish Ag star after the US grain harvest.

You can now receive occasional free weather and commodity discussions at S U B S T A C K (CLICK HERE)

For specific trading and hedging strategies and much more frequent commodity weather ideas, and our BestWeather Spiders for all commodities:

CLICK HERE to request a 2-week free trial.

Image source: WeatherWealth Newsletter

Thanks for your interest in Commodity Weather Intelligence !!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA-registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.